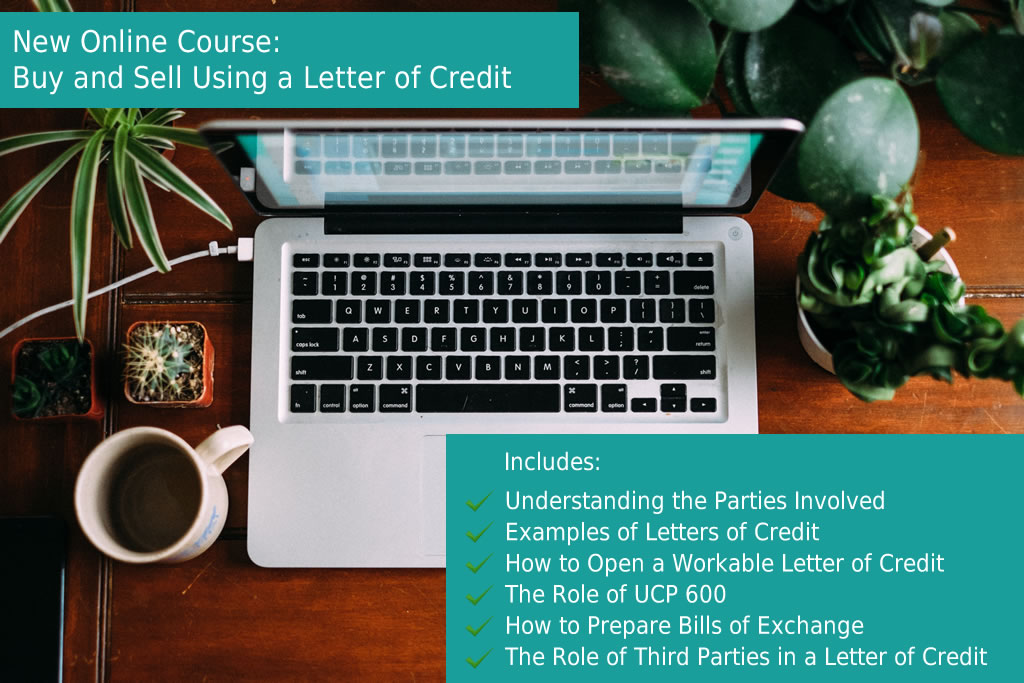

New Online Course Now Available For 2024

Our new “How To Buy and Sell Using a Letter of Credit” course teaches you practical lessons you need to know and understand if you’re going to be using Letters of Credit to raise finance. Developed by Alan Bracken, with over 35+ years of experience in international trade.

Alan has a vast amount of experience with the Letter of credit process and teaches you how to correctly raise a Letter of Credit as well as specified documents that will be required, what to avoid and ensure you understand as well as how to deal with a non-compliant Letter of Credit.

Course cost is just £399, enroll now.

What is Letter of Credit? – The Basics Explained

In the following video, Alan Bracken explains the basics of a Letter of Credit in international trade and important points to be aware of if you intend to use one as a method of payment.

In this video, the following points are discussed:

- The Definition of a Letter of Credit

- Why Trade Under a Letter of Credit?

- Types of Letters of Credit

- A Way To Make Money Without Money?

- The Rules of UCP600

Knowing how to use a letter of credit is an important part of international trade as it’s a very versatile instrument and when used correctly, a very import method of payment to have in your trade finance arsenal, helping both the buyer and seller and can importantly, ensure that you get paid.

- Defining a Letter of Credit

- How Does a Letter of Credit Work?

- The Different Types of Letters of Credit

- UPC 600 – The Rules of the Game

- A Letter of Credit Example

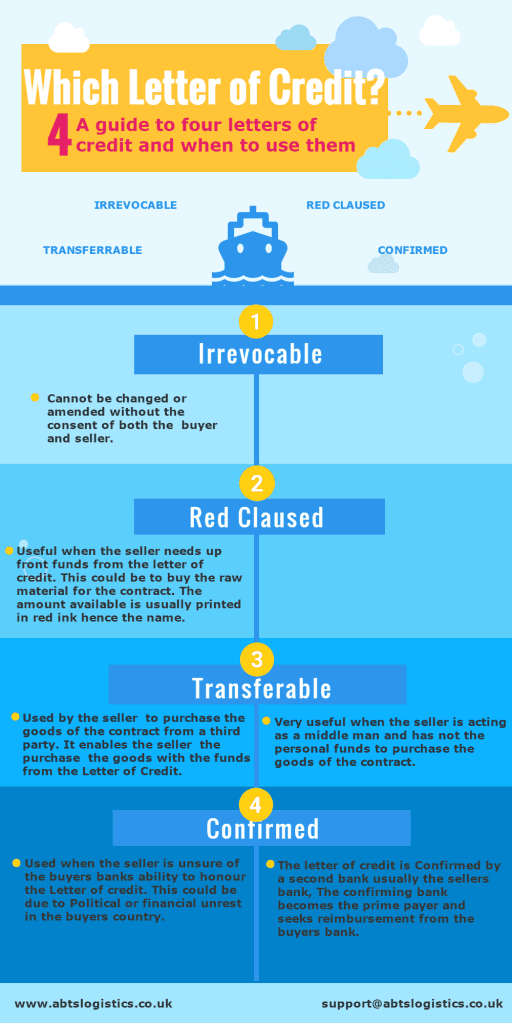

Letter of Credit Definition:

With a letter of credit the issuing bank or financial institution guarantees payment to the seller within a time frame and for a stipulated amount. If the buyer does not pay the seller but the issuing bank is responsible for payment on presentation by the seller of the stipulated documents. In addition to this, a letter of credit can allow the seller to receive funds before the goods are delivered, which can be advantageous if capital is needed up front.

How Does a Letter of Credit Work?

A letter of credit in international trade, is a conditional guarantee to the seller to receive payment by the issuing bank or financial institution. Being paid by a letter of credit as a seller is advantageous because it will provide security to you, you don’t need to worry about the state of your buyers business. Once you receive the letter of credit, you can ship the goods to the buyer without worrying about the buyers cash flow, available funds or if they were to even go bankrupt and close their doors. You would still be paid.

For sellers, this can be very beneficial for new customers giving you large orders as it reduces the risk of non payment because the bank pays you.

However, the most important point that I can’t stress enough is that a letter of credit is a conditional bank guarantee, that on correct presentation of the STIPULATED documents required, as the seller, you’ll be paid.

What this means is in simple speak, is that you will have to present to the buyer’s bank the stipulated documents within the letter of credit in order to be paid. The issuing bank does care and has no interest in the goods themselves. They don’t care if the goods were received by the buyer, they don’t care what the goods are, they don’t care if the goods sank on the vessel on the way to the port of destination. They only care about the presentation of the stipulated documents.

Once they are correctly presented, they will issue payment to you, the seller. An important point to note is that 70% of letters of credit are unpaid on first presentation so it’s vital that you understand how a letter of credit works if you’re going to start trading using one.

How Does it Work?

The workings of a letter of credit is a complicated process and not something that I would ever recommend to anyone that doesn’t have a very good understanding of the process. With that in mind, this blog is not intended to be a detailed guide on how a letter of credit works but more of an overview.

If you want to understand the inner workings and the process involved I highly recommend enrolling in our online Letter of Credit course.

So lets look at this from the perspective of the seller. A potential buyer contacts you and asks you to quote for 100 widgets which you oblige and send back your quotation or proforma invoice with your terms of payment as a letter of credit with instructions on how the letter of credit should be setup.

The order is accepted at which point, the buyer should contact you to discuss the details of the letter of credit and to make sure that the letter of credit is workable for you. The buyer will have to state what documents they want to be presented for payment.

This in itself is very involved and beyond the scope of this introduction but what needs to be understood is that the buyer will need those certain documents required to clear the goods through customs once they arrive at the port of destination. What those certain documents are will depend on various factors and we won’t go into any more detail on that.

So the buyer will state what documents they require in order to clear the goods through customs which should be agreed with the seller beforehand and once agreed, the buyer will go to their bank and ask to setup a letter of credit.

The buyer will have to prove the source of funds or arrange a loan from the bank and the letter of credit is issued with the agreed STIPULATED DOCUMENTS to be presented by the seller for payment.

Beware the SCAMMERS!!

A letter of credit should never be received directly from a buyer but should only ever be received by a nominated bank which the seller will nominate, usually their own bank where the company bank account will be.

If a letter of credit is ever received directly from a buyer, it’s a fraud and never ship the goods. It’s a SCAM.

Receiving the Letter of Credit

Once the nominated bank receives the letter of credit from the issuing bank the seller will be notified and they can prepare and ship the order of 100 widgets. The widgets sail off on the vessel headed for the buyers warehouse at which point the seller must organise the STIPULATED DOCUMENTS for presentation to the bank.

Stipulated Documents

The process of organising and ensuring that the stipulated documents are correct on first presentation is a subject on it’s own and not something that can be covered in this introduction.

This should not be underestimated and again I would like to point out that 70% of letters of credit go unpaid on first presentation so it’s essential to know exactly what the stipulated documents are and present them in the correct format.

This is covered in our online Letter of Credit course and again, please consider enrolling if you’re going to be dealing with letters of credit.

For this introduction, we will assume that the seller has all the stipulated documents and that they are in good order, everything is correct and they confirm to UCP 600 (see below for more on UCP 600).

The stipulated documents are presented to the bank and approved at which point the bank pays, the funds are released to the seller and the documents are forwarded on to the buyer so they can clear the goods through customs.

Beware – letters of credit have time limits…they expire so you must be aware that you have to complete the process and provide the stipulated documents by the deadline in the terms of the letter of credit in order to receive payment from the financial institution or buyer’s bank. As long as you submit before the deadline, you’ll have nothing to worry about and the bank pay’s.

This is a very basic overview or what a letter of credit is and how it works but please don’t be lulled into a false sense of security that they are easy to work with.

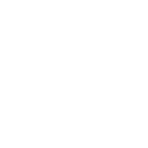

Types of Letters Of Credit

There are several types of letters of credit so lets start with the four most common types and when to use a letter of credit in international trade.

IRREVOCABLE

An irrevocable letter of credit, once it’s born, cannot be changed or amended without the consent of both the buyer and seller.

RED CLAUSED

This clause is very useful when the seller needs to raise funds from the letter of credit, for example to buy raw material for a building contract. The amount available is usually printed on the letter of credit in red ink, hence the name “red claused”.

TRANSFERABLE

This type of letter of credit can used by the seller to purchase goods needed to fulfill the contract from a third party. For example, steel, concrete and brinks to complete a building contract. This is extremely useful when the seller may not have available funds to purchase the goods to complete the contract, so could use this method to raise those funds by guaranteeing payment to the third party supplier.

CONFIRMED LETTER OF CREDIT

These letters of credit are used when the seller is unsure of the buyers’ bank’s ability to honour the letter of credit perhaps due to political or financial unrest in the buyers country. The letter of credit is confirmed by a second bank (the confirming bank) which is usually the seller’s bank. The confirming bank becomes the prime payer and seeks reimbursement from the buyer’s bank. This is a little complicated but will be made clear as we dive into the detail.

To embed this infographic, copy and paste the code below:

Letters Of Credit – A Way to Make Money Without Money?

A transferable letters of credit in international trade, enables the seller (or beneficiary) to buy products to fulfill the sales contract from a third party without using their own funds, instead using the funds from the contract itself. Think of it as an advance on the payment (opposed to a guarantee on non payment) that will be received on completion of the contract. Once this “mother” letter of credit has been born, it can be split up and transferred to as many parties as needed as long as the total does not exceed the amount of the original “mother” letter of credit.

Transferable letters of credit are often successfully used to purchase high value goods without having to dip into company funds where cash flow may be tight and the company may not be sitting on bundles of cash and need to receive payment before delivery of the goods or project. Be warned however, they are not as simple to obtain and use as some would like you to believe. It certainly should not be considered a way to make money, without money.

Standby Letters Of Credit

There is one other type which is not actually meant to be used, which is known as a standby letter of credit.

This is a last resort or safety net for the seller reducing the financial risk within the contract. It’s basically a guarantee of the payment from the issuing bank on the behalf of the seller.

If the buyers business for some reason was to declare bankruptcy or was just unable to make the payment, this would make the confirming bank pay but the intention is that it will never need to be used. This letter of credit is usually issued in good faith providing proof that the buyer’s credit is in good standing with the issuing bank and that they will be able to make the payment without any issues.

The buyers company will undergo a credit check before the issuing bank releases the letter of credit giving security that the company is stable and not under any financial trouble.

UCP 600

Something else to be aware of relating to letters of credit is that there have been a set of rules created and agreed by the International Chamber of Commerce, known as the Uniform Customs and Practice for Documentary Credits (commonly called “UCP”), which banks and financial institutions that issue letters of credit are subject to.

This is a subject on its own so we won’t go into detail here but it’s certainly something you must be aware of. See our video below for details on UCP 600 to get you started:

A Letter of Credit Example

Using a real world example, we can hopefully show you more clearly the process and just how letters of credit work.

Not so long ago we were asked to work with a small London based building company who had been awarded a nicely sized contract to build a brand new, modern sports facility in the United Arab Emirates.

The high end sports facility would include a swimming pool, saunas in the changing rooms, two basketball courts, a full size gym with aerobic equipment as well as a lounge area complete with table tennis and pool tables and health bar. As you can imagine, this type of facility doesn’t come cheap and the contract value was negotiated and agreed at just over £1.6 million (GBP). This included the raw materials, exporting of the required materials that could not be sourced within the UAE and the construction of the facility.

How To Raise £1.6m

As you can probably imagine, most businesses don’t have £1.6m sitting in their company bank account so raising the funds to complete the project was something that needed to be handled. This company took the traditional avenue and approached their bank for finance but for one reason or another weren’t granted the entire amount. They subsequently approached other finance companies who offered them funds but the terms of repayment weren’t suitable. At this point, the project looked to be in jeopardy and the contract had to be reconsidered.

On contacting ABTS®, we suggested that they ask their client in the UAE for a transferable letter of credit from their bank. What this meant was that the client approach their bank (issuing bank) and ask them to issue a transferable letter of credit for the value of £1.6 million, which is passed to the UK building company. This assures that funds are available and that the payment will be made if the correct documents are presented by the UK company, such as invoices, bills of lading, bill of exchange, packing list and others. The issuing bank is guaranteeing the money and becomes responsible for the payment, guaranteeing funds in the event of non payment. Negotiation skills need to be on point with this as, as mentioned before, there is a cost to the client in the UAE to issue this letter of credit.

Letter Of Credit Broken Down

As this is a real-word example, lets break down what was actually included in this letter of credit and the inner workings of it.

CONFIRMED LETTERS OF CREDIT

This particular letter of credit was issued from the clients bank in the UAE via a bank located in the UK, so it was this UK issuing bank that was ultimately responsible for paying out the £1.6m. This UK bank was unknown to the building company in the sense, they had no relationship with the bank, so in order to minimise their risk, they asked their bank, Natwest for a confirmed the letter of credit.

What this means is, Natwest confirms the letter of credit exists (taking away the risk of any fraud, which unfortunately does happen) and that they (Natwest) will honour it on the presentation of all the relevant and correct documents.

As you may have guessed, Natwest do not do this for free and charge our building company a fee for this confirmed letter of credit but it’s a fee that gives our building company peace of mind.

TRANSFERABLE

A transferable letter of credit is a letter of credit that simply means the building company can “break up” the letter of credit and use it to pay who they need to pay, for example, steel suppliers. As mentioned earlier, a transferable letter of credit can be broken up from one “mother” credit, into “child” credits and distributed as long as the combined value does not exceed the mother letter of credit.

RED CLAUSED

As mentioned above, a “red clause” is a letter of credit that allows a stated percentage of the value of the credit to be received by the building company, effectively in cash and be used for immediate expenses, such as paying staff during the building period.

In this case of the UK builder requested a 5% red clause and used this money for up front costs such as architects fees and plans, staff costs and engineer’s site visits.

To embed this infographic, copy and paste the code below:

Letter Of Credit Explained

Almost half of the letters of credit received in the UK are unworkable according to some research, the buyer requests documents which the seller may be unable to produce, so be aware and be proactive, not reactive.

As you can see, knowing how to use letters of credit are a great way to fulfill projects when cash is tight but it’s really important to know what you’re doing as they can be complicated and you must be aware of the types of letters of credit for use. If you get it wrong, you could be left holding the can and unfortunately there are many horror stories of contracts going desperately wrong due to people not understanding how to properly establish and use letters of credit. Don’t be one of them and get the right letter of credit training!

Import Export Training Course Online

If you’re looking for an in-depth understanding of letters of credit, ABTS Training offers an online letter of credit course, taught with a series of pre-recorded videos. Study at your own pace, no deadline to finish and lifetime access to your course.

Our course teaches you the practical knowledge you’ll need to know to trade successfully and get paid under a letter of credit. Taught by Alan Bracken, with 35+ years of commercial experience in logistics, he gets into the fine, practical details of letters of credit and how to make sure you setup correctly and get paid.

We were voted Best Trade Education Provider in 2017 by Trade Finance Global and our course has been validated by the London Institute of Shipping and Transport.

Check out our reviews on TrustPilot to see just how our courses have benefited our students.